What Everybody Ought To Know About How To Apply For The Housing Tax Credit

Ad sell your home with simplicity, speed and certainty.

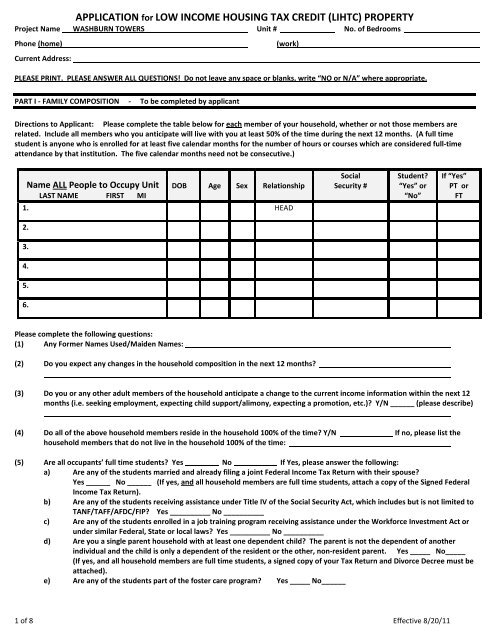

How to apply for the housing tax credit. To apply for the credit, the first important thing to note is the deadline is coming fast—september 15 but the application can be done online, so there’s still time. Qualified home purchasers should apply in advance for the homeowners' tax credit before acquiring title to the property. Created by the tax reform act of 1986, the.

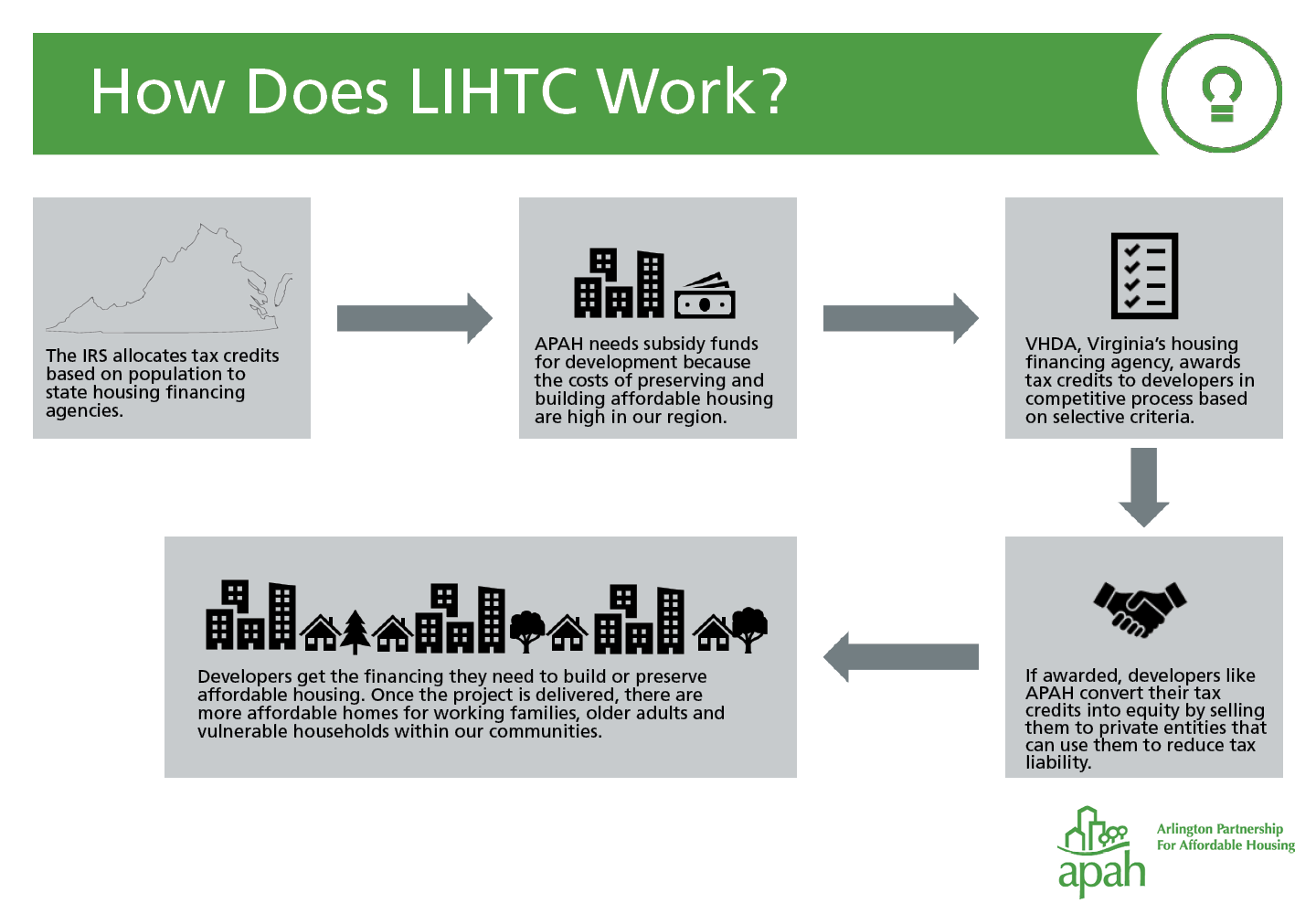

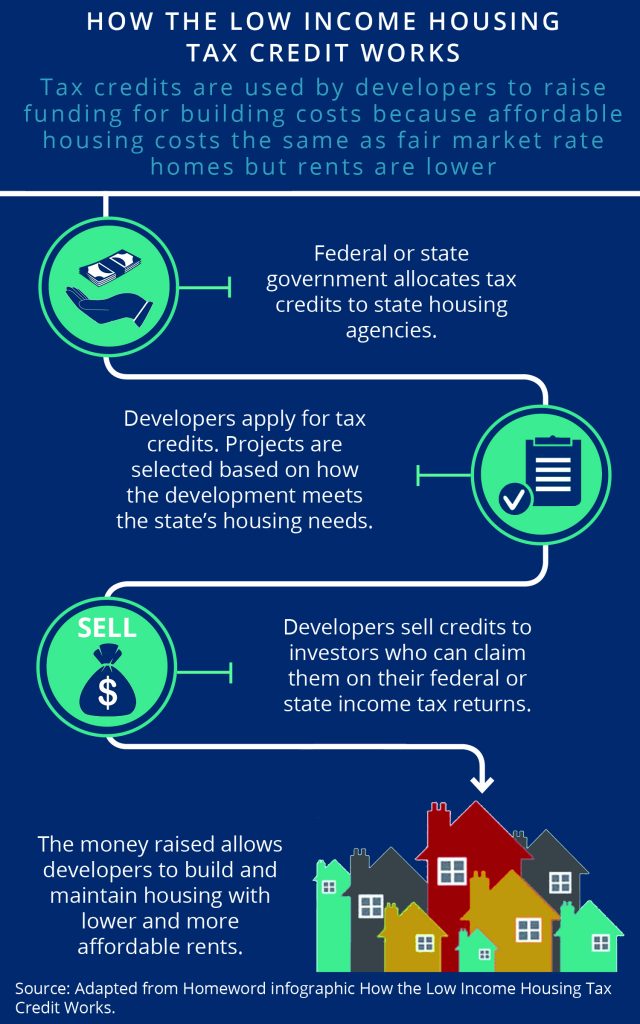

The 9% htcs are allocated twice per year through a competitive process: The program regulations are under section 42 of the internal revenue code. Federal law mandates developments to separately apply to the housing finance agency (hfa) for the 4% credits.

Apply for housing tax credits. Prime minister justin trudeau has announced a number of new programs, including the launch of a new dental care program, doubling the gst tax credit temporarily, and. Apply for housing tax credits.

Dhcd makes low income housing tax credit funding available through a notice of funding availability (nofa), twice yearly. Housing credits provide a federal income tax credit as an incentive to investors. Applicants must complete and submit the one stop housing.

Submitting an application to the state’s competitive allocation process in conformance with the state’s qap; Being awarded (or denied) a reservation of the credits it. The application must be obtained per the housing office’s instructions.

The tax credit encourages developers to build affordable housing to meet the needs of the community. The purpose of this program is to help reduce the. The oahtc allows banks to reduce interest rates on loans for affordable housing by 4% and claim a state income tax credit equal to the lost interest income caused by the lower rate.

![Infographic] The Low Income Housing Tax Credit Program: How Does It Work? | Wilson Center](https://www.wilsoncenter.org/sites/default/files/styles/embed_text_block/public/media/images/article/lihtc-mechanism-chart.png)