Exemplary Info About How To Become A Loan Officer

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Here are steps on how to become a loan officer without experience:

How to become a loan officer. Detailed loan officer career path guide: Create a profilewith the nationwide multistate licensing system & registry(nmls). The components for the mlo exams are unique for each state.

A commercial loan officer is often paid on commission, usually 1/2 of 1 percent of the amount of the loan. Enjoy more flexibility as an independent mortgage broker. For loan officers working in banks and credit unions, there are no licensing requirements to date.

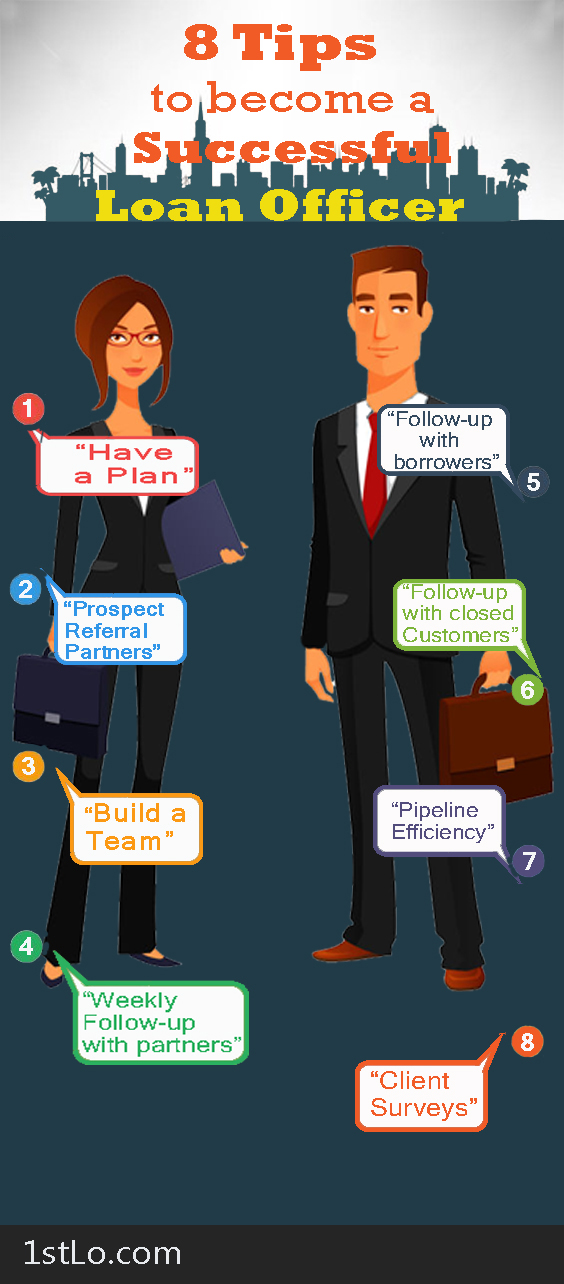

How do loan officers become experts in reverse mortgages? How long does it take to become a loan officer? Here are the skills you will need to possess if you hoping to pursue a successful career as a loan officer:

Get certified through the mortgage bankers association (mba) and. Becoming a loan officer requires getting a license. Six steps to becoming a mortgage loan officer step one:

After 25 years working for the same company, it was sold out and my office closed down. If you’ve been considering becoming an expert, consider becoming a certified reverse mortgage professional. You’ll want to have the following skills to work as a loan officer:

In 2020, the median annual wage for a loan officer will be $63,960. Earn a bachelor’s degree (optional) obtain your mortgage loan officer (mlo) license. Becoming a mortgage loan officer, or mlo, specifically with an independent mortgage broker in the wholesale channel, is a promising career path that offers flexibility,.

![Become A Mortgage Loan Officer [A 2022 Step-By-Step Guide]](https://ijungo.com/wp-content/uploads/2019/10/1208976_HowToBecomeAMortgageLoanOfficer_101521.png)

/loan-officer-526035_final-f4ca32ef67784514a9cd7f42a9bc8bf9.png)

![How To Become A Loan Officer [Step-By-Step License Guide]](https://lo.vintagelending.com/wp-content/uploads/2021/03/how-to-become-a-loan-officer-infographic.png)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)